ADA Price Prediction: Technical Breakout and Whale Accumulation Signal Path to $1

#ADA

- Technical Momentum: ADA trading above 20-day MA with improving MACD suggests building bullish pressure toward $0.95 resistance

- Market Sentiment: Positive news flow around whale accumulation and reduced selling pressure supports upward price movement

- Risk Factors: $73 million liquidation risk near $1 threshold requires careful position management and stop-loss considerations

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Moving Average

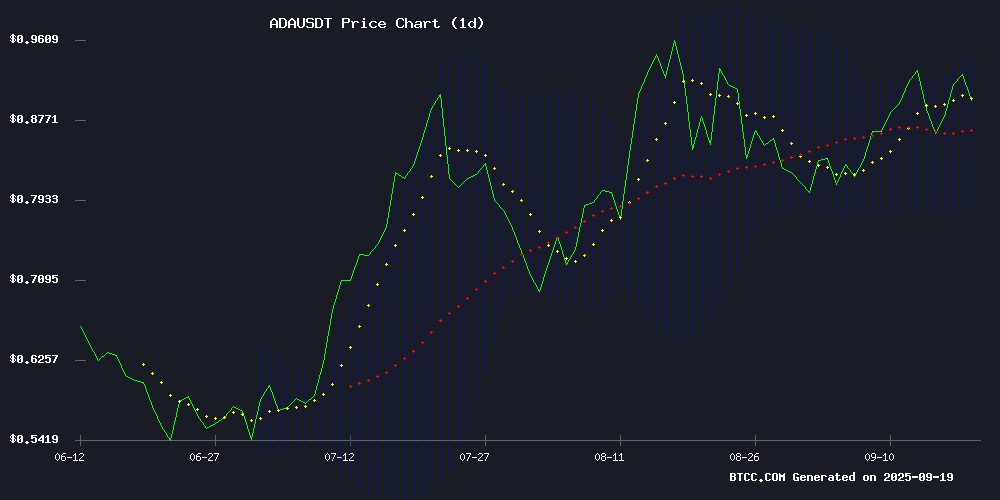

ADA is currently trading at $0.9084, positioned above its 20-day moving average of $0.8656, indicating underlying bullish momentum. The MACD reading of -0.0378 remains in negative territory but shows improving momentum with the histogram at -0.0231. Price action NEAR the upper Bollinger Band at $0.9464 suggests potential resistance, while the middle band at $0.8656 provides support. According to BTCC financial analyst Ava, 'ADA's position above the 20-day MA combined with narrowing MACD negative values suggests building upward pressure toward the $0.95 resistance level.'

Market Sentiment: Bullish Catalysts Drive ADA Toward $1 Threshold

Recent news headlines highlight significant bullish sentiment surrounding Cardano, with traders facing $73 million in liquidation risks as ADA approaches the psychological $1 barrier. Multiple reports indicate short-term sellers are retreating while whale wallet accumulation continues to rise, supporting predictions of a potential rally toward $1.80. BTCC financial analyst Ava notes, 'The combination of technical breakout potential above $0.92 and fundamental whale accumulation creates a compelling bullish narrative that aligns with the current technical setup.' Market sentiment appears overwhelmingly positive, though the $1 level may present initial resistance.

Factors Influencing ADA's Price

Cardano Traders Face $73 Million Liquidation Risk as ADA Eyes $1 Threshold

Cardano's Chaikin Money Flow indicator has surged to a two-month high, signaling robust capital inflows and growing trader optimism. The altcoin's price action suggests an impending test of the psychologically critical $1 level, a MOVE that could trigger $73.5 million in short liquidations.

Market dynamics reveal a precarious balancing act. While forced short covering could propel ADA higher, the subsequent reduction in open interest may create temporary volatility. The liquidation heatmap identifies key price levels where cascading liquidations may occur, presenting both opportunity and risk for position traders.

Technical indicators show ADA consolidating above support, with sustained buying pressure needed to maintain upward momentum. The coming sessions will prove decisive as the market weighs potential liquidation-driven rallies against the threat of profit-taking pullbacks.

Cardano Price Surges as Bulls Target Breakout Above $0.92

Cardano's ADA has rallied over 12% in three days, testing a critical resistance level at $0.92 that has capped gains since mid-August. On-chain data reveals short-term holders are reducing sell pressure, with Santiment's 30–60 day Spent Coins Age Band dropping to 47,230 ADA—signaling decreased liquidations from this typically volatile cohort.

Technical indicators reinforce the bullish case. The Chaikin Money FLOW hit a 42-day high of 0.11, reflecting robust capital inflows. A decisive close above $0.92 could propel ADA toward $0.98, while failure may see a retreat to $0.84 support.

The convergence of slowing distributions and strengthening demand paints a constructive picture for Cardano's near-term trajectory. Market participants now watch whether this momentum can cement a new higher trading range.

ADA Climbs as Short-Term Sellers Retreat, Targets Rally Above $0.92

Cardano's ADA is gaining momentum as short-term holders reduce sell-offs, creating conditions for a potential breakout above the $0.92 resistance level. On-chain data reveals a steady decline in Spent Coins Age Band (30d-60d) activity, indicating decreased selling pressure from recent buyers.

The altcoin's rally appears supported by genuine capital inflows, with its Chaikin Money Flow reaching a 42-day high. This technical strength coincides with broader market demand for ADA, fueling a double-digit price surge over the past three trading sessions.

Market observers note that when short-term speculators hold rather than dump positions, it typically reduces volatility and creates firmer footing for sustained advances. Santiment's metrics tracking wallet movements confirm this pattern is currently playing out in ADA markets.

Cardano Price Prediction: $1.80 ADA Possible With Whale Wallet Accumulation Rising

Cardano is reclaiming market attention as on-chain data reveals accelerating accumulation by large holders. Wallets holding over 1 million ADA have steadily increased balances during consolidation—a pattern that historically precedes upward price movements. Analysts interpret this whale activity as a bullish signal, projecting potential upside toward $1.80 in coming months.

The altcoin's positioning as a mid-cap blend of security and growth coincides with broader institutional interest across crypto markets. While Cardano demonstrates fundamental strength, speculative projects continue attracting risk-tolerant capital seeking asymmetric returns.

Is ADA a good investment?

Based on current technical indicators and market sentiment, ADA presents a compelling investment opportunity for bullish cryptocurrency investors. The price currently trades above its 20-day moving average with improving MACD momentum, while news sentiment indicates strong whale accumulation and reduced selling pressure.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $0.9084 | Bullish above 20-day MA |

| 20-day MA | $0.8656 | Support level |

| MACD | -0.0378 | Improving momentum |

| Bollinger Upper | $0.9464 | Near-term resistance |

| Price Target | $1.00-$1.80 | Based on whale accumulation |

However, investors should monitor the $0.95 resistance level and consider risk management given the potential for volatility around the $1 psychological barrier.